Rival Risk

Trading Risk Management Software solution built for professional risk managers and traders on a fully hosted, cloud-based platform.

Voted Best Risk Solutions Provider by Waters Ranking 2022.

“Rival was made and designed by traders for traders. That makes a huge difference for those of us who spent most of our careers on custom-built, proprietary systems.” - Rod Valeroso, Commodities Trader at BUDOGROUP

Supported Brokers and Exchanges

Analyze market risk from every angle and scale your business with enterprise risk management on a single cloud-based platform.

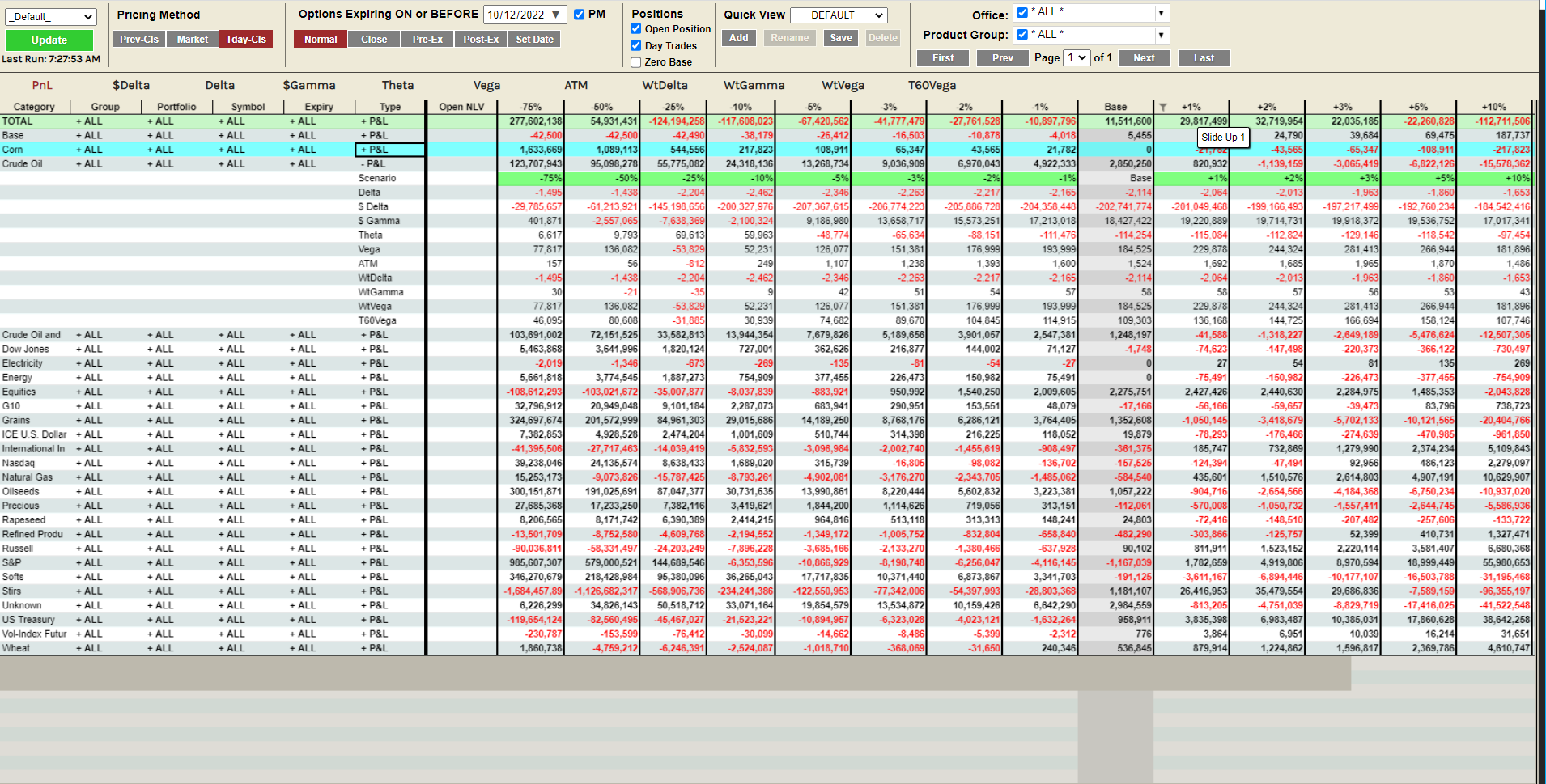

Precision in Any Market Condition

Our proprietary algorithms provide accurate volatility, theoretical prices, and Greeks, even in volatile or illiquid markets. Automatically calculated synthetic prices ensure you always know your risk.

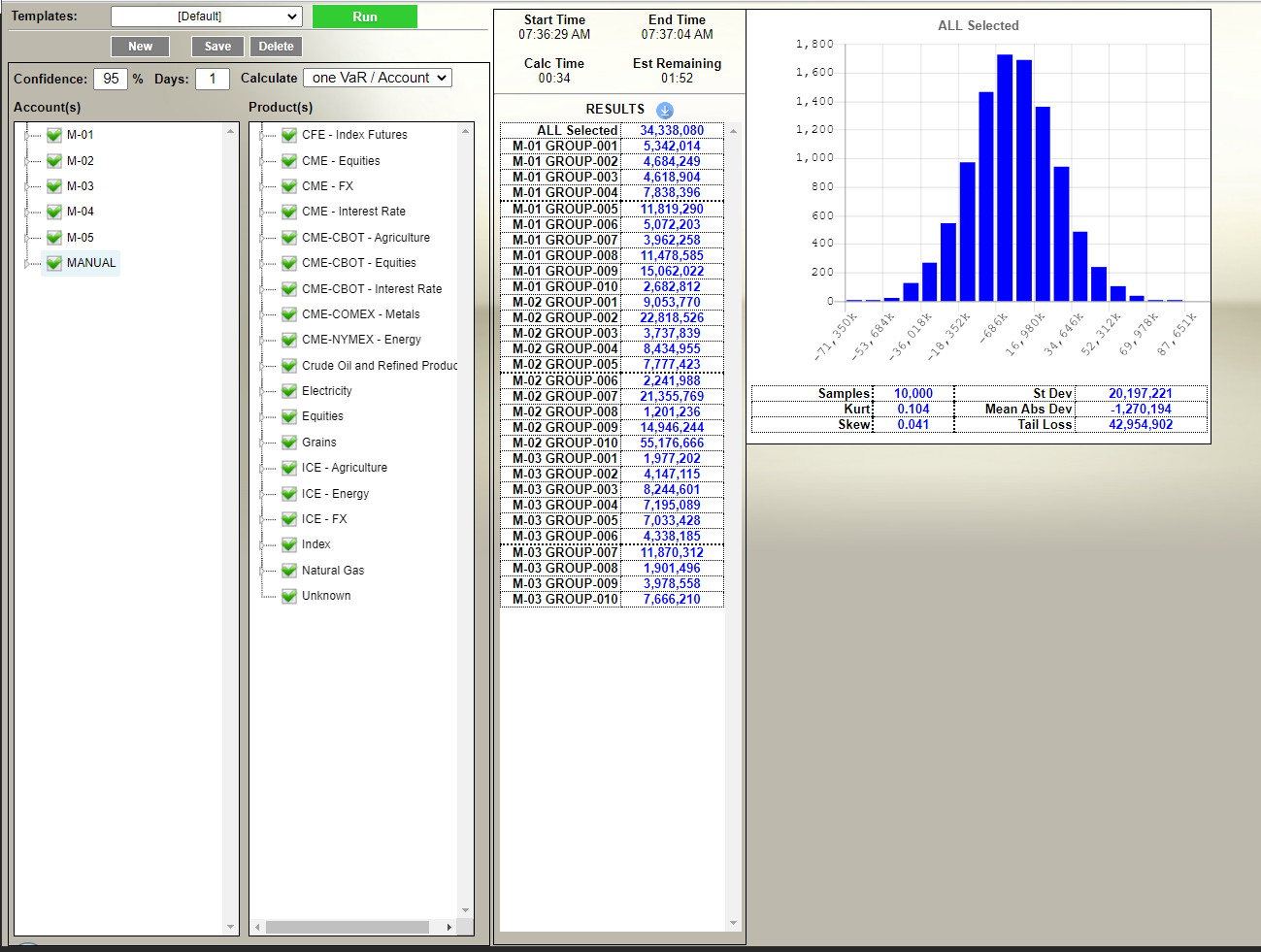

On-Demand VaR & User-Defined Simulations

Calculate Value at Risk (VaR) instantly across all accounts using Monte Carlo simulations. Generate risk slides with custom scenarios and see the impact of potential trades immediately.

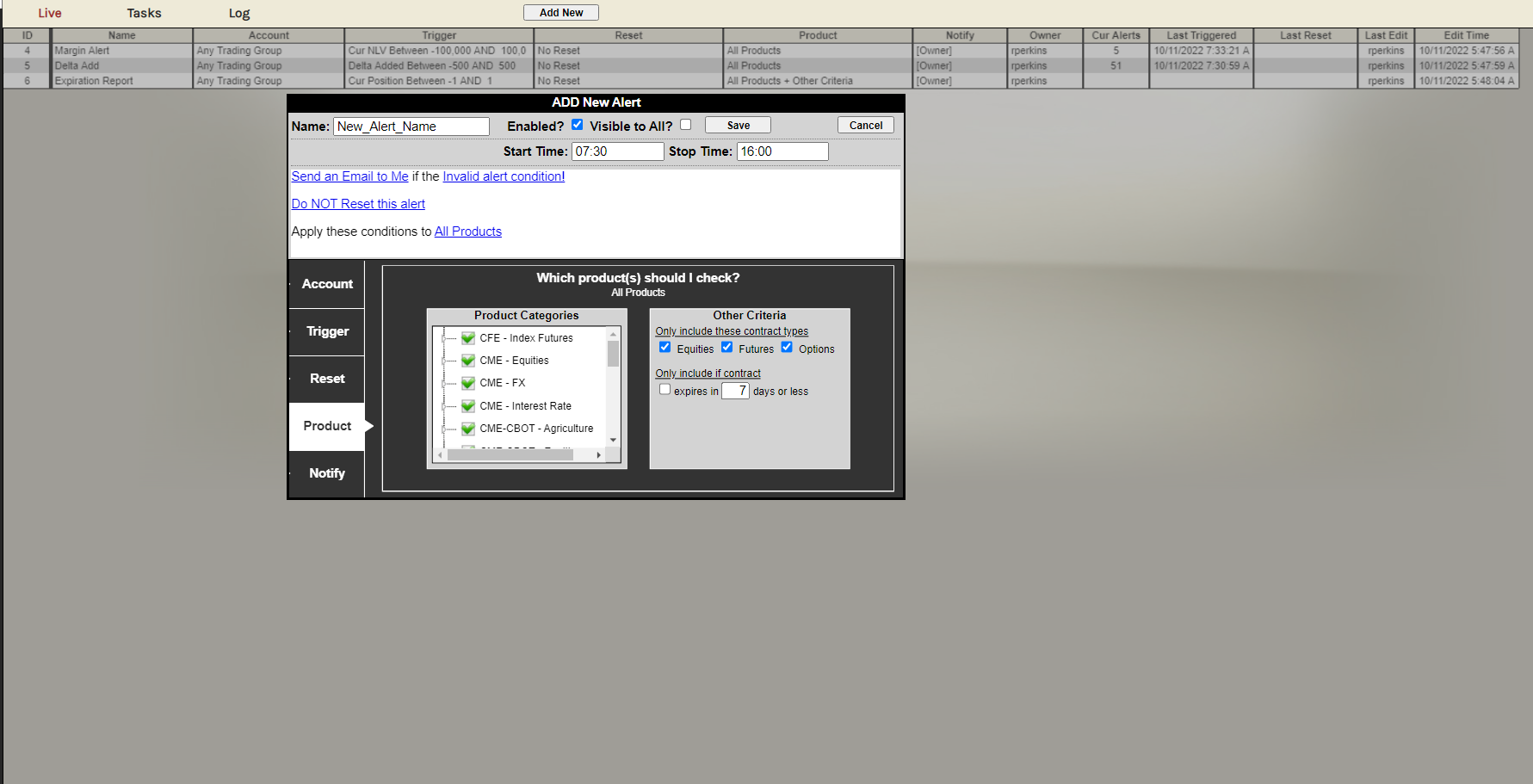

Stay Informed, Anytime, Anywhere

Receive real-time email alerts for preset conditions across all accounts and product categories. Stay informed and act swiftly, wherever you are.

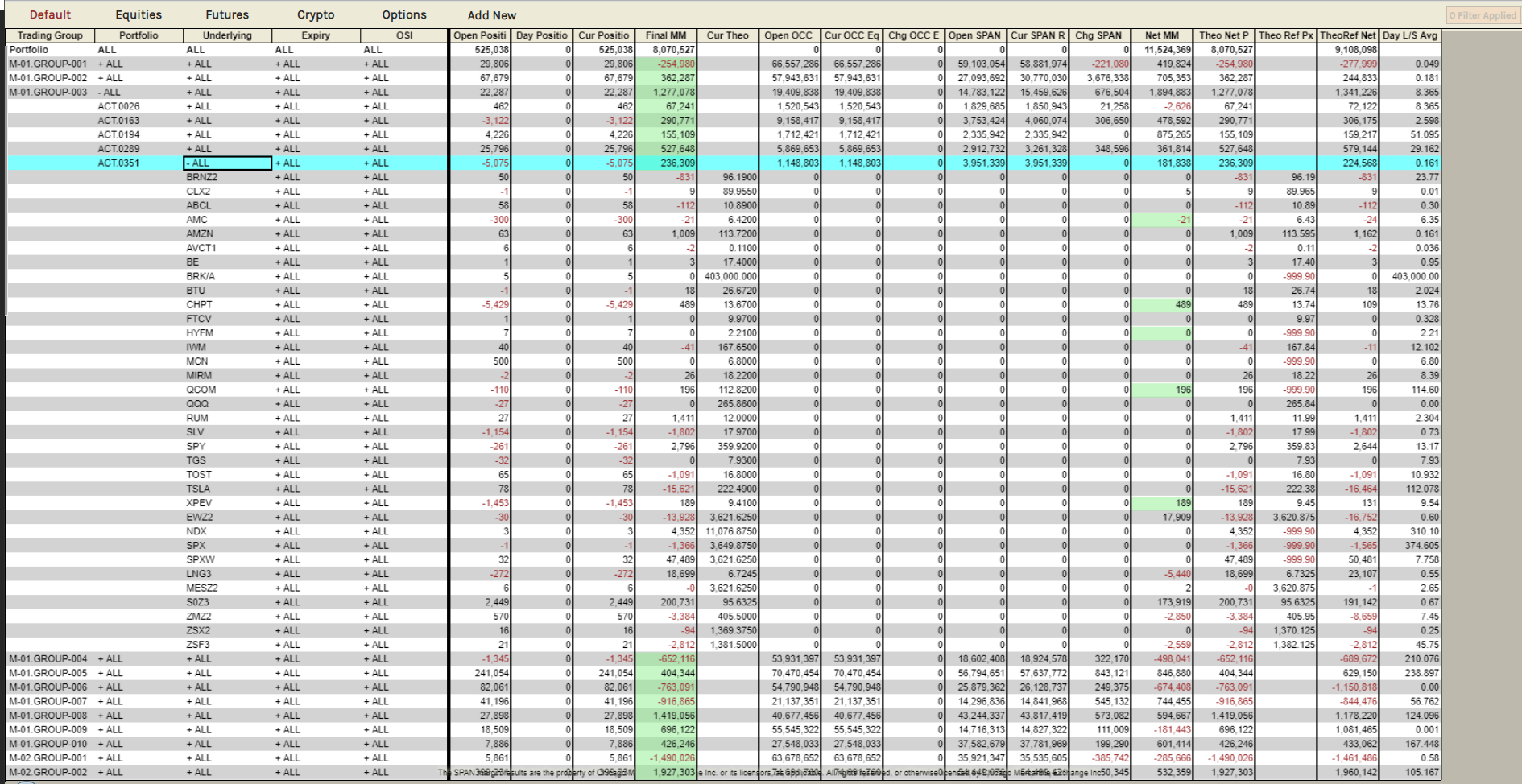

Global Market Coverage

Seamlessly integrate with major clearing firms and brokers for streamlined start-of-day positions, account balances, and real-time trade data. Access data from major North American, European, and Asian exchanges without extra costs.

“Switching to Rival was a no-brainer – the multi-asset trading platform is faster, cheaper, easier to use and the support team is top-notch.”

Brendan Delovitch, Arb Trading Group

“Rival was made and designed by traders for traders. That makes a huge difference for those of us who spent most of our careers on custom-built, proprietary systems.”

Rod Valeroso, Commodities Trader at BUDOGROUP

Ready to book a Demo?

Trusted by

See Rival Risk In Action

Multi-Asset Platform

Expand your trading capabilities with our platform that supports futures, options, equities, and bonds. Manage and diversify your portfolio efficiently, all in one place.

Centralized Trade and Position Server

Experience seamless trading with a centralized server that consolidates trade and position data. Receive drop copies from clearing firms, exchanges, and brokers for comprehensive and real-time tracking.

Precision Pricing and Analytics

Gain a competitive edge with our proprietary algorithms that calculate theoretical prices and Greeks for options, as well as synthetic prices for back month futures and swaps. Make informed decisions with precise and accurate data.

User-Defined Scenarios & VaR

Customize your risk assessments with user-defined scenarios, Value at Risk (VaR), and real-time margin calculations. Quickly evaluate potential trades and their impact on your risk profile.

HTML5 Application

Trade on-the-go with our HTML5 application, accessible from any computer or mobile device. Stay connected and in control, no matter where you are.

Stay Ahead with Real-Time Alerts

Receive instant email alerts for any preset conditions across all accounts and product categories. Act swiftly and stay informed, ensuring you never miss a critical market move.

Automated Reporting

Save time with automated reporting that delivers comprehensive and timely reports. Focus on your trading strategies while we handle the data crunching.

Permission-Based Logins

Control access with permission-based logins for internal users or clients. Ensure security and confidentiality while providing tailored access to essential information.